Safeguard Your Home and Liked Ones With Affordable Home Insurance Coverage Program

Significance of Affordable Home Insurance

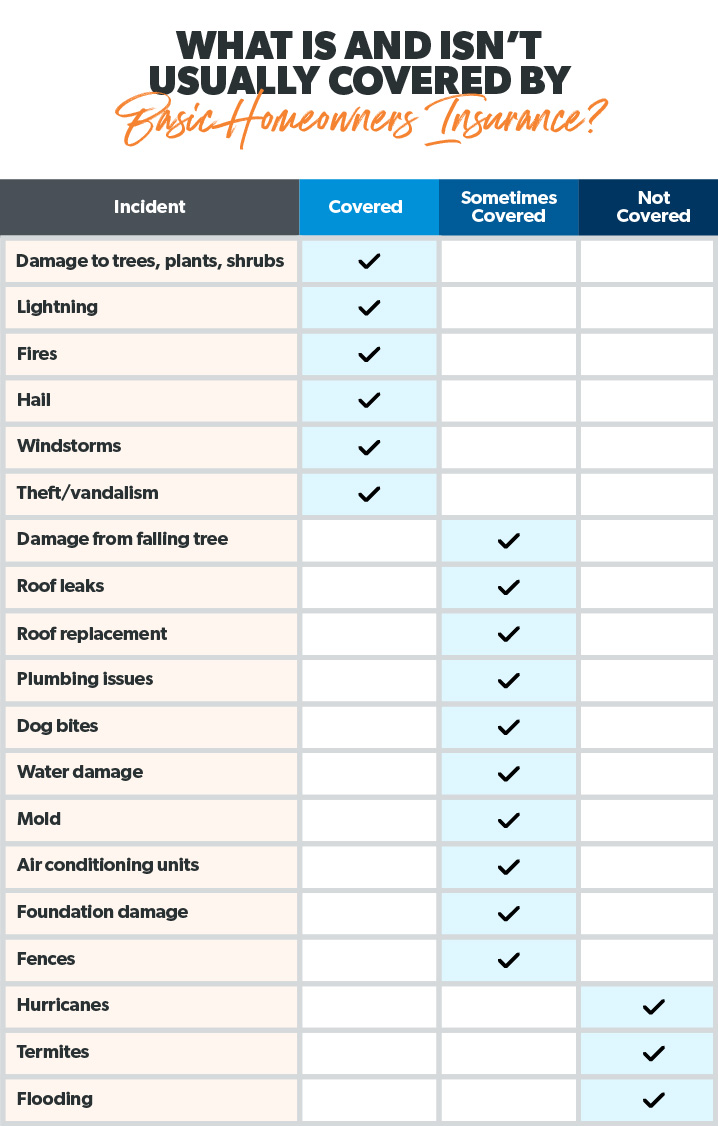

Protecting cost effective home insurance policy is essential for protecting one's home and economic well-being. Home insurance gives defense against numerous risks such as fire, burglary, natural catastrophes, and personal obligation. By having a thorough insurance coverage strategy in position, home owners can relax guaranteed that their most considerable financial investment is shielded in case of unforeseen scenarios.

Budget-friendly home insurance coverage not only provides monetary protection yet additionally offers satisfaction (San Diego Home Insurance). In the face of increasing building worths and construction costs, having a cost-effective insurance coverage makes sure that property owners can conveniently restore or repair their homes without facing substantial monetary burdens

Furthermore, budget friendly home insurance can likewise cover individual possessions within the home, offering reimbursement for things damaged or stolen. This protection extends beyond the physical framework of your house, shielding the components that make a house a home.

Protection Options and Boundaries

When it comes to protection restrictions, it's vital to comprehend the maximum amount your policy will pay out for every type of coverage. These limitations can vary depending on the plan and insurer, so it's necessary to review them carefully to ensure you have appropriate protection for your home and possessions. By comprehending the protection choices and limitations of your home insurance plan, you can make enlightened decisions to guard your home and enjoyed ones successfully.

Elements Impacting Insurance Coverage Expenses

Numerous variables substantially influence the expenses of home insurance coverage plans. The area of your home plays an essential duty in identifying the insurance coverage premium.

In addition, the type of coverage you choose straight impacts the price of your insurance plan. Deciding for extra insurance coverage options such as flood insurance policy or earthquake coverage will certainly enhance your costs.

Furthermore, your credit history, asserts history, and the insurance coverage firm you pick can all affect the cost of your home insurance coverage. By thinking about these variables, you can make informed decisions to help handle your insurance coverage sets you back successfully.

Contrasting Quotes and Providers

Along with contrasting quotes, it is critical to assess the credibility and monetary security of the insurance policy companies. Search for consumer evaluations, rankings from independent agencies, and any kind of background of continue reading this grievances or regulative activities. A trustworthy insurance service provider ought to have a good performance history of quickly processing cases and supplying superb customer care.

Moreover, think about the specific insurance coverage attributes used by each supplier. Some insurance companies might use extra advantages such as identity burglary protection, equipment malfunction coverage, or protection for high-value things. By carefully contrasting quotes and companies, you can make an educated choice and select the home insurance coverage plan that ideal fulfills your needs.

Tips for Minimizing Home Insurance Policy

After completely contrasting service providers and quotes to discover the most suitable protection for your needs and budget, it is sensible to check out efficient approaches for conserving on home insurance coverage. Many insurance coverage business provide price cuts if you purchase numerous plans from them, such as combining your home and automobile insurance policy. Consistently evaluating and upgrading your plan to show any kind of changes in your home or situations can guarantee you are not paying for protection why not find out more you no longer requirement, aiding you save money on your home insurance premiums.

Conclusion

In conclusion, protecting your home and loved ones with economical home insurance is important. Applying tips for saving on home insurance coverage can also aid you secure the necessary protection for your home without damaging the bank.

By unraveling the ins and outs of home insurance plans and discovering sensible approaches for safeguarding cost effective insurance coverage, you can make sure that your home and loved ones are well-protected.

Home insurance coverage plans usually provide several coverage choices to safeguard your home and belongings - San Diego Home Insurance. By comprehending the coverage choices and limitations of your home insurance coverage plan, you can make informed choices to safeguard your home and loved ones efficiently

Routinely evaluating and upgrading your plan to show any type of adjustments in your home or scenarios can guarantee you are not paying for insurance coverage you no longer demand, assisting you conserve money on your home insurance costs.

In final thought, guarding your home and liked ones with budget-friendly home insurance is critical.

Comments on “San Diego Home Insurance Can Be Fun For Everyone”